During periods of moderate to high inflation, raking in cash is the way to stay ahead of the inflation curve. What are some of the best defensive stocks? Companies that deal with basic staples often do well during inflationary periods because consumers will focus on core staples above all other things.

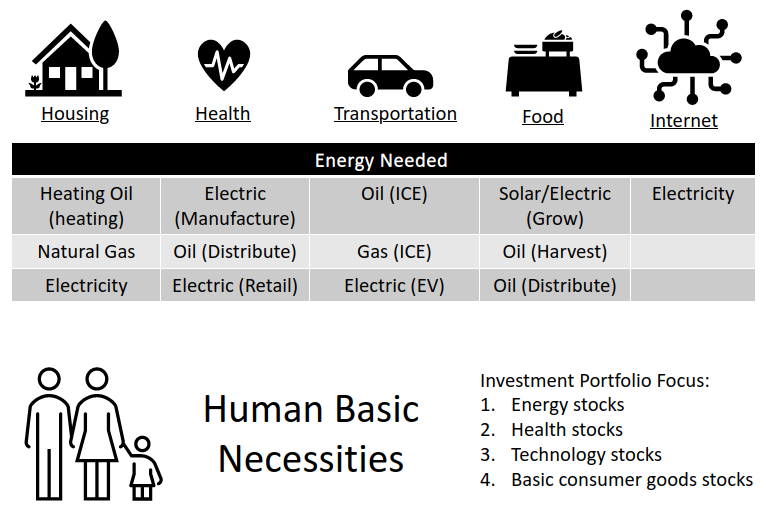

Let’s break down what some of those things are for most families.

First, families need a place to live and whether that home is a house, an apartment or an RV, they will all require some basic things. Because climate changes almost everywhere most families will need energy to cool or heat their homes. For most homes, heating is accomplished through heating oil, natural gas, or electricity. For cooling, it is often done through electricity and an air conditioning unit.

Secondly, families need food. There is nothing complicated about food, there are food producers, food distributors, food retailers and finally consumers. There is also high dependency on energy in this food supply chain so keep that in mind.

Third, families need transportation. Whether that transportation is an owned or leased vehicle, a shared ride, public transit or walking these things all require energy of some form.

Fourth, families need healthcare. Healthcare comes in many forms but the most basic is medicine and health insurance. According to a 2013 Mayo Clinic report, 7 in 10 Americans take prescription medications. Millions take flu vaccinations yearly and it appears covid vaccinations may be the way of the future as well.

Lastly, families need to communicate. In pre-industrial times communications were done through letters or in person conversations but today a minimum requirement to function comfortably requires internet connectivity. Whether that internet connectivity is done through a fiber connection at your home or a wireless signal on a cell phone, internet access is a core requirement in our view.

As we take stock of our basic human necessities and translate that onto the financial investment world we can observe we need to focus on four key areas:

- Energy companies

- Health (and Insurance) companies

- Technology companies

- Housing (REITs) & Basic consumer goods companies

Ideally, we build our diversified portfolio around all of these types of companies but there are some core things we want to tick off on our checklist.

- Reasonable P/E

- Regular Dividend Payment

- Diversified customer base (preferably global)

- Diversified products/services (preferably globally or multi-nation or multi-state)

- Track record (stability)

As we stated before in prior post, as of November 12, 2021 the stock market, in general, is highly over valued. With an upcoming boomer retirement tsunami hitting in 2030, we need to ensure that the companies we invest in will have the right resiliency to make us money.

We continue to do our analysis and will share some of that in the near future.

[…] of the income is generated. Remember, we want to position our investments into a combination of defensive mode and growth mode so it’s important we run through the research process. Keep in mind that […]

[…] Image Courtesy: Unsplash.com […]

[…] best thing to do is to ensure you have additional income coming in to help pay for basic necessities. We think the best way is to build a defensive portfolio (priority) coupled with a growth portfolio […]

[…] that you are generating additional income either at work or through investments. As we stated in Basic Economy (Defensive) Stocks, these are the things people will focus on when prices get out of control for other goods and […]

[…] do we plan on protecting ourselves? By focusing on investments that provide the most fundamental and basic support that humans need. There is no guarantee that we won’t take hits like everyone else […]

[…] to attract workers (inflation), lack of goods and services (more inflation), and high demand for basic essentials. The best thing to do is to prepare yourself financially for these […]