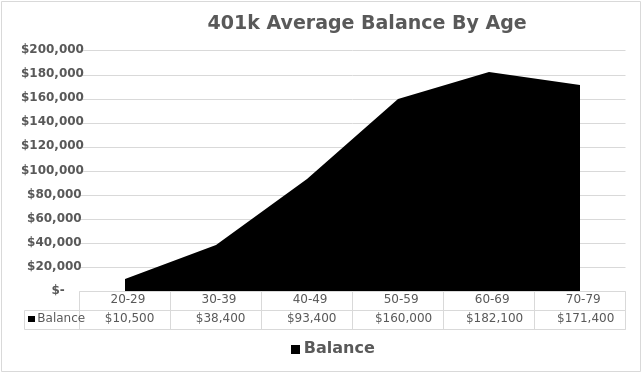

If readers are wondering why we are spending time looking at retiring overseas in Mexico, Malaysia, Colombia or other places then keep reading. Investopedia recently published a post about the average 401k for Americans based on data from Fidelity. We took the data and created these charts.

The average 401k balances look very depressing during a time of inflationary pressures of lower productivity, aging workforce and retiring boomers. We don’t expect inflation to come down as 60 million boomers retire over the next 8 years, we expect it to go up. So what does the highest balance of $182,100 actually buy?

Assuming TODAY that a retired 60-69 year old person could capture a 6% return on an investment of $182,100, what does that mean for monthly income? The annual return for that capital and rate of return is about $11,000. We’ll be generous and round up to $12,000 annually or about $1,000/month.

According to this article, most of the rents in major metros are running at least $1100/month with large cities breaching almost $1500/month or higher. Considering the exploding costs of foods, healthcare and other goods and services these 401k balances won’t cover most expenses.

There are a few solutions to the problem, either reduce spending and lifestyle or transform the purchasing power of those $182,100 into 2x or 3x by relocating to a country with a lower cost of living.

We cannot emphasize enough that according to the Census.gov, 60 million baby boomer will hit age 65+ in 2030. In America, this means that 1 out of every 5 Americans will be on social security and medicare putting demands on the remaining 3 out of 5 Americans because the other 1 out of 5 will be too young, too sick or too rich to be a contributing member of society to productivity. Essentially we will be left with 3 out of 5 American serving the other 2 out of 5 Americans. Would you rather be taking care of baby boomers or living a decent life in a lower cost country?

We hope to have our dividend stock portfolio, real estate rental properties, REITS and other investments provide enough income for us to live a comfortable lifestyle and the best way to optimize that will be to live in a lower cost country.

In a future post, we’ll share how we plan on optimizing our decision making and country selection process. In the meantime, stay tuned and stay solvent…