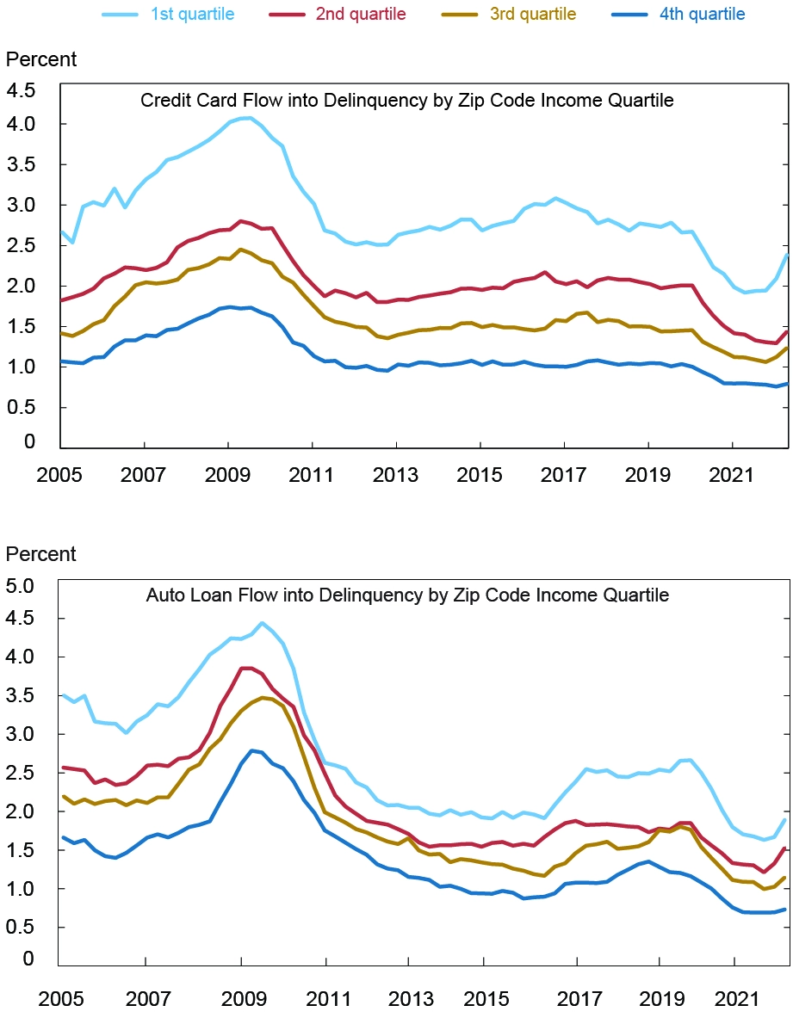

The New York Fed has a report with various graphs showing the rise in delinquencies for credit card and auto debt. Let’s take a look.

Total household debt increased by $312 billion during the second quarter of 2022, and balances are now more than $2 trillion higher than they were in the fourth quarter of 2019, just before the COVID-19 pandemic recession, according to the Quarterly Report on Household Debt and Credit from the New York Fed’s Center for Microeconomic Data. All debt types saw sizable increases, with the exception of student loans.

New York Fed

Given that the Federal Reserve will continue to raise interest rates thereby increasing the cost of debt we wanted to know how we could profit from upcoming defaults.

Bloomberg reported recently that average credit card rates are now 18% for most consumers.

Consumers who carry a balance on credit cards are paying an average annual interest rate of 17.96%, according to Bankrate.com. That compares to 16.21% at this time last year.

Bloomberg.com

We pulled some charts and graphs of various companies that may benefit from debt and defaults and we’ll let you know our exciting findings in a future post.

In the meantime, stay tuned and stay solvent…