The BLS released the inflation report today and while some progress has been made inflation is not moving in the right direction.

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.2 percent in July on a seasonally adjusted basis, the same increase as in June, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.2 percent before seasonal adjustment. The index for shelter was by far the largest contributor to the monthly all items increase, accounting for over 90 percent of the increase, with the index for motor vehicle insurance also contributing.

The food index increased 0.2 percent in July after increasing 0.1 percent the previous month. The index for food at home increased 0.3 percent over the month while the index for food away from home rose 0.2 percent in July.

The energy index rose 0.1 percent in July as the major energy component indexes were mixed. The index for all items less food and energy rose 0.2 percent in July, as it did in June. Indexes which increased in June include shelter, motor vehicle insurance, education, and recreation. The indexes for airline fares, used cars and trucks, medical care, and communication were among those that decreased over the month.

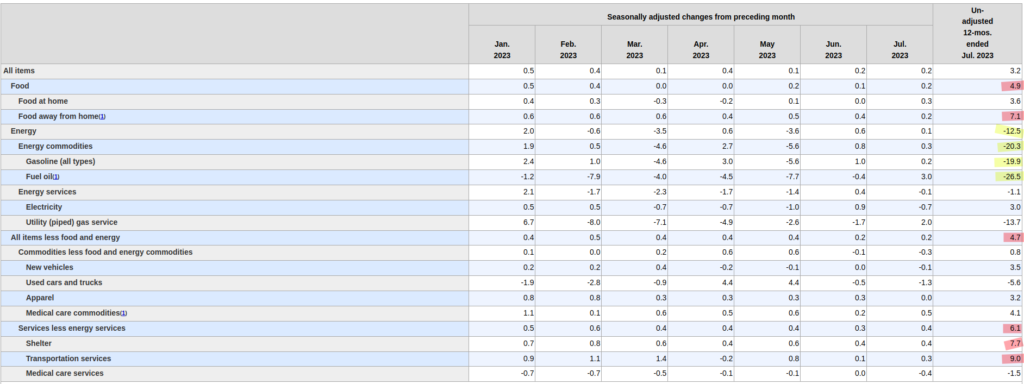

The all items index increased 3.2 percent for the 12 months ending July, slightly more than the 3.0-percent increase for the 12 months ending in June. The all items less food and energy index rose 4.7 percent over the last 12 months. The energy index decreased 12.5 percent for the 12 months ending July, and the food index increased 4.9 percent over the last year.

BLS.gov

The table form is a much better view of where the inflation hots pots are right now.

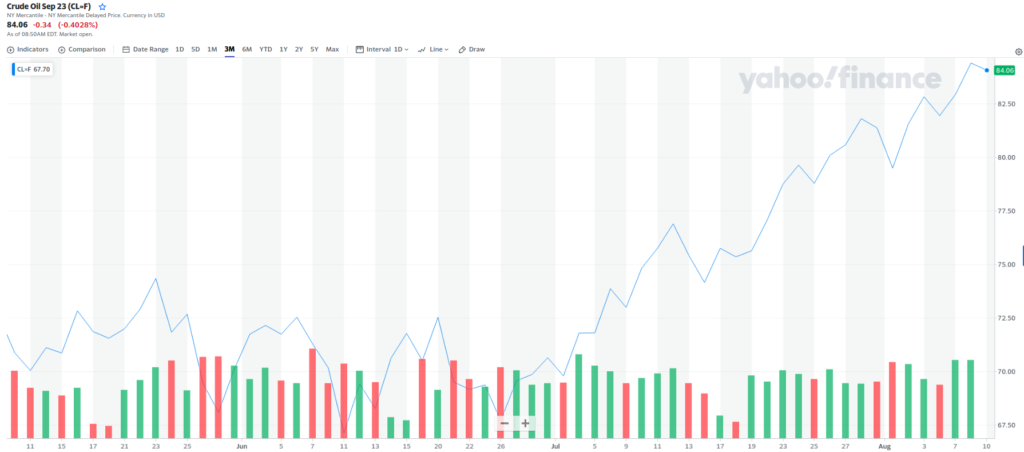

Food inflation year over year is still up 4.9 percent. Food at restaurants is up 7.1 percent. Services are also extremely elevated. Note the yellow highlighted areas that show significant drops however as of this posting oil is trading at $84/bb and has been rising over the past few months.

If inflation “moderation” largely happened as a result of energy prices coming down then it will likely “un-moderate” and fly higher over the next few months. Additionally, with many strikes and some unions like UPS scoring big pay contracts, we think wage inflation will continue to climb higher and those areas have already been hot. Don’t forget that every month about 10,000 boomers leave the labor force and the labor participation continues to decline as an overall trend.

Not enough labor, spiking energy prices, wage hikes are all a recipe for higher inflation and likely more Fed rate hikes which means our portfolio will continue to be focused on T-Bills and some energy stocks. We also still hold PUT positions on XHB should we get a huge inflation surprise by September and the Fed decided to put the hammer down and go 50 basis points or higher. To find out what happens, stay tuned, stay profitable and stay solvent…