The Kansas City Fed had an excellent release discussing the current labor shortage paradigm and we suggest everyone read it. Here are some key points:

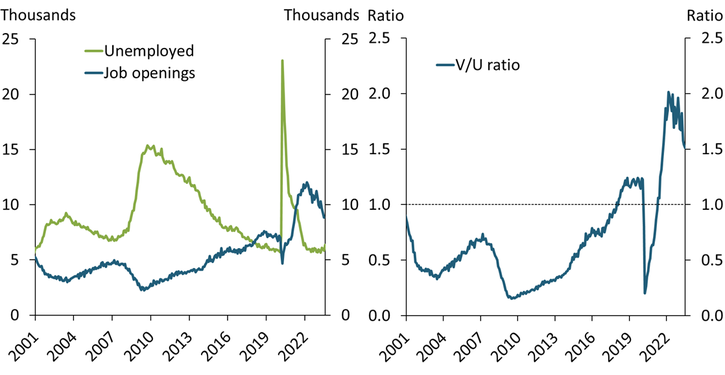

From 2001 thru 2019 there were always more unemployed looking for jobs than there were open jobs but that changed after the COVID pandemic. Since 2020, there have been more jobs than labor.

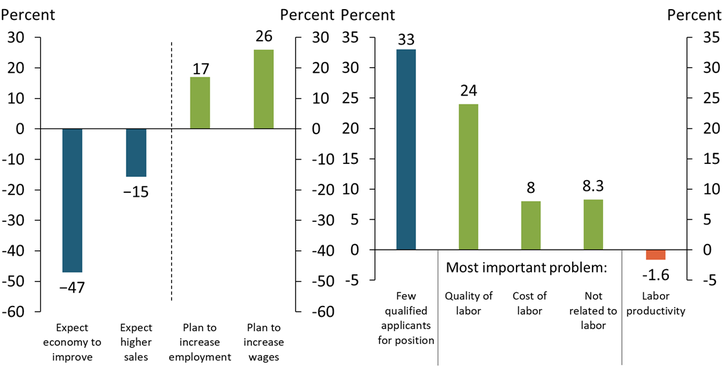

The second chart has more interesting survey data in that a core issue with the labor market is the inability to find qualified candidates.

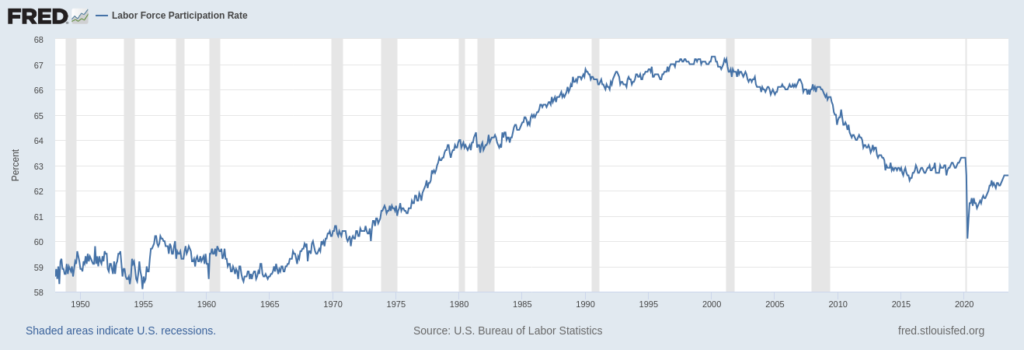

Unfortunately, the Kansas City Fed completely ignored one key problem with the labor market: boomers retiring. There is no mention of the fact that 50 million baby boomers are retiring over the next 7 years and millions have already retired.

The St. Louis. Fed’s labor participation rate shows the decline of labor participation trend since 2000 with a sharp drop during COVID pandemic in 2020. While the labor participation rate has climbed up from the abyss, we doubt it will cross the 2019 participation trend line because the people simply don’t exist. Unless immigration reforms are implemented to bring in more labor, the trend line will continue to skew down and flat.

The Kansas City Fed concludes that labor hoarding is why the Fed’s interest rate hikes haven’t impacted labor but we think the true cause is the declining labor participation as millions of boomers retire.

Whatever the true cause of the current labor mess, it doesn’t matter, what does matter is that the ultimate result of the labor shortages is more inflation for goods and services.

We’ll be on the lookout for a way to profit from this so stay tuned, stay profitable and stay solvent…