The BLS released PPI report and while goods inflation is down, services (the labor part) is unchanged. From the BLS:

PRODUCER PRICE INDEXES – OCTOBER 2023

The Producer Price Index for final demand fell 0.5 percent in October, seasonally adjusted, after advancing 0.4 percent in September, the U.S. Bureau of Labor Statistics reported today. (See table A.) The October decline is the largest decrease in final demand prices since a 1.2-percent drop in April 2020. On an unadjusted basis, the index for final demand rose 1.3 percent for the 12 months ended in October.

In October, the index for final demand goods fell 1.4 percent. Prices for final demand services were unchanged. The index for final demand less foods, energy, and trade services advanced 0.1 percent in October, the fifth consecutive rise. For the 12 months ended in October, prices for final demand less foods, energy, and trade services moved up 2.9 percent.

Final Demand Final demand goods: Prices for final demand goods moved down 1.4 percent in October, the first decrease since falling 1.5 percent in May. A major factor in the October decline was the index for final demand energy, which dropped 6.5 percent. Prices for final demand foods fell 0.2 percent. Conversely, the index for final demand goods less foods and energy edged up 0.1 percent.

Product detail: Over 80 percent of the October decline in the index for final demand goods is attributable to a 15.3-percent drop in prices for gasoline. The indexes for diesel fuel; hay, hayseeds, and oilseeds; home heating oil; liquefied petroleum gas; and light motor trucks also fell. (In accordance with usual practice, most new-model-year passenger cars and light motor trucks were introduced into the PPI in October. See Report on Quality Changes for 2024 Model Vehicles at www.bls.gov/web/ppi/ppimotveh.htm.) In contrast, prices for tobacco products increased 2.4 percent.

The indexes for butter and for residual fuels also moved up. (See table 2.)

Final demand services: Prices for final demand services were unchanged in October following six consecutive advances. In October, increases of 1.5 percent in the index for final demand transportation and warehousing services and 0.1 percent in prices for final demand services less trade, transportation, and warehousing offset a 0.7-percent decline in margins for final demand trade services. (Trade indexes measure changes in margins received by wholesalers and retailers.)

Product detail: Within the index for final demand services in October, prices for airline passenger services rose 3.1 percent. The indexes for chemicals and allied products wholesaling, inpatient care, outpatient care (partial), and truck transportation of freight also increased. Conversely, margins for machinery and vehicle wholesaling declined 2.9 percent. The indexes for apparel, footwear, and accessories retailing; portfolio management; traveler accommodation services; and health, beauty, and optical goods retailing also fell.

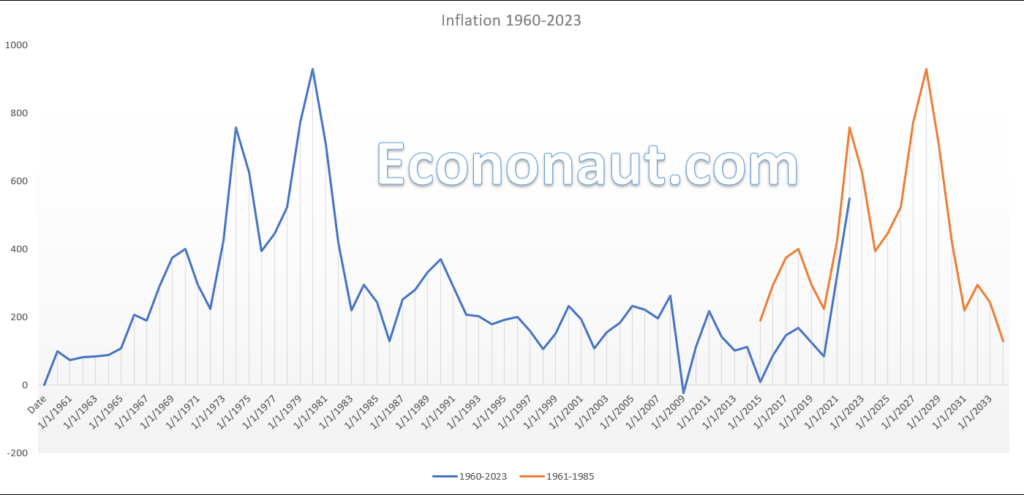

The overall drop was largely driven by fuel prices and services (which requires labor) hasn’t changed at all. It seems to us that inflation reduction is a temporary trend and will likely spike up again in the near future. In Comparing Inflation 1960 to 2023, we made the case that inflation is following an eerily similar pattern to the 70s to 1980s where inflation spiked.

The big question is will the Fed learn from their past mistakes or will they repeat them again? Everyone seems to think the Fed is done hiking and may pivot soon but we think that will be a mistake. To find out, stay tuned, stay profitable and stay solvent….