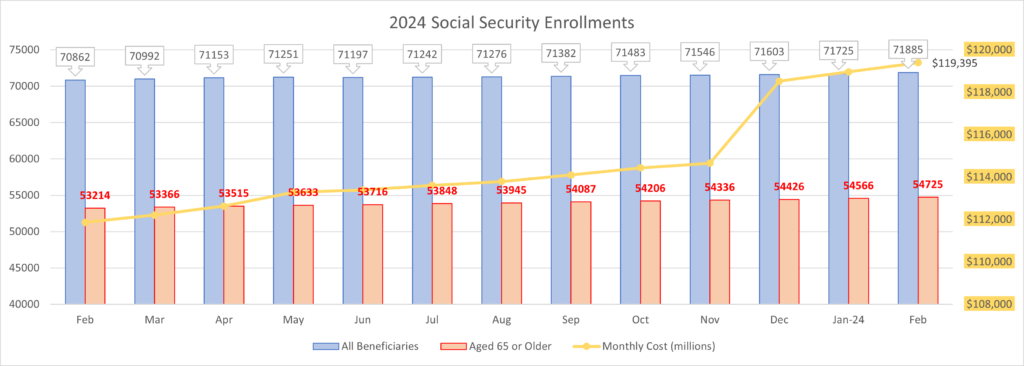

The social security administration released the February 2024 snapshot and there was a huge jump in enrollments. For February 2024, there were 160,000 new social security enrollees over the age of 65. The current monthly cost of the current benefits is $119.3 billion according to the latest data disclosure. This represents an increase of $429 million dollars to the social security cash outlay.

We think one of the core reasons inflation isn’t abating is because the US Government is effectively handing out $120 billion / month to retired people. That is a great deal of money to spend on a variety of things throughout the economy.

There are now 71,885,000 people collecting social security and we assume most of those people have left the labor force or if continue to contribute to the labor force, they are doing so as part time workers, hobbyists, or volunteers.

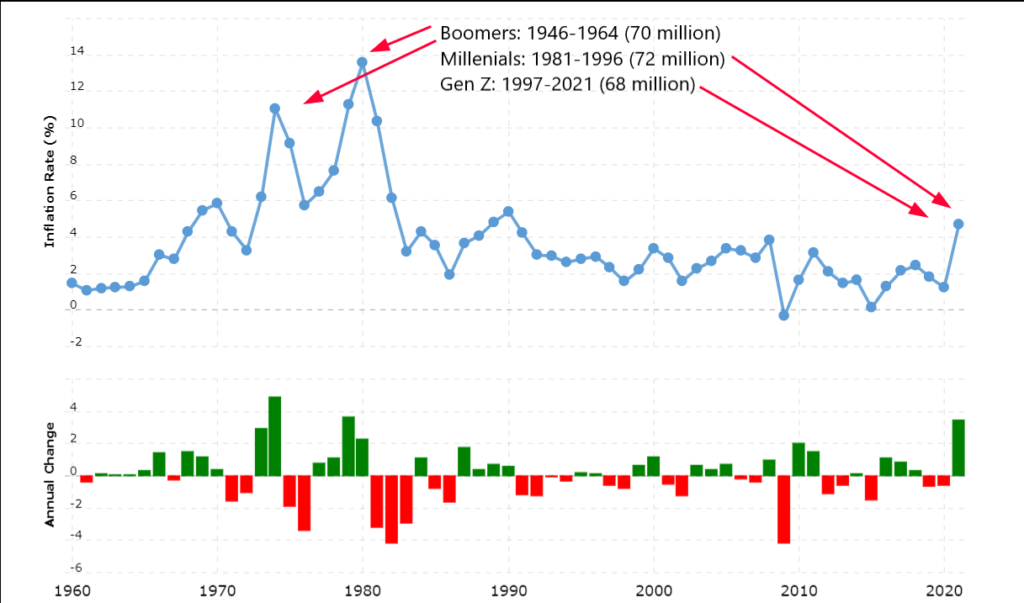

We seem to be repeating the inflationary problems of the 1970’s. Back then a hoard of baby boomers came of age in the late 70s and began getting married and having families. Today we have Millennial and Gen Z generations coming into family formation age trying to get into an under developed housing market. The Gen Z and Millennial generations are TWICE as large as the boomer but the key issue is that boomers aren’t disappearing, they are simply retiring in droves leaving an experience gap in the labor force and consuming resources like all other generations.

If history holds, we may see 10 percent or 15 percent inflation again over the next 10 years so that by the 2030’s we’ll be in a full inflationary spiral.

The assets that do well during these inflationary periods are real estate, commodities, and other hard assets. We continue to research how to profit off of these new paradigms so stay tuned, stay profitable and stay solvent…