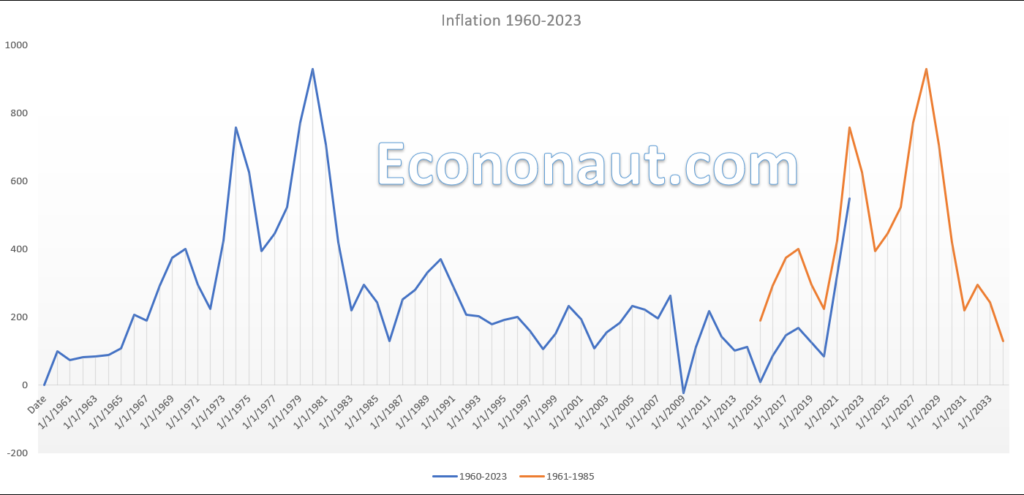

While the world is cheering lower inflation and some central banks around the world have been cutting rates with the United States potentially poised to cut rates in September, we will ring the alarm bell and warn that inflation will spike up again 18 to 24 months from now, perhaps sooner.

Our primary thesis has not changed. By 2030, all 70 million baby boomers will be over the age of 65 and able to claim social security and enroll in medicare. This single event alone will cause massive labor shortages on a scale not seen before anywhere on earth.

Additionally, Millennials and Zoomers will be in full family forming stage driving demand for goods and services in a near repeat of 1970s inflation. We “mirrored” the potential inflationary path up ahead and we don’t think we’re far off. The fed will likely pat itself on the back on bringing inflation down and in reaction to slowing economic growth so it will cut rates slowly and likely cause a slow rise in inflation over time. We expect this to pay out over the next 5 to 7 years similar to 1973 through 1980.

Housing

It’s not surprising that while housing sales activity has cooled, the housing prices recently reached all time highs. During the period of high inflation in the 70’s, housing prices kept rising and never really correct back to their lower values, they only kept going up. It is certainly possible that economically hard hit areas will see home values plunge no different than $5 houses available in Detroit today but in desirable growing areas housing prices may likely remain high and go higher.

How To Position?

Our thesis on this is to focus on companies with plenty of free cash flow, high profit per employee and ability to optimize labor forces with technology or other methods to remain profitable. We have a list of companies that we continue to track and evaluate.

To learn more, stay tuned, stay profitable and stay solvent….