We read a whole lot of information from a variety of sources including economic data from governments around the world, journalists and economic bloggers and the debate amongst many seems to be whether inflation is an issue and whether or not inflation is “transitory” or a more permanent experience in everyone’s life.

Our primary concerns with inflation come down to three key points:

- What is the level of inflation? We care about this because higher costs for raw materials, goods and service will lead to higher costs in production, output and ultimately consumption. This is true not just for the US but all of its trading partners.

- Does the inflation that matters growing, stable or declining? We care about inflation that impacts consumers directly that cause them to have a change in spending patterns. It doesn’t matter if the price of Osmium is sky high if the element’s uses are fairly limited to a very small number of people. If however the price of beef is sky high and that causes consumers to buy chicken or pork instead, it will directly impact businesses across the board from restaurants, grocers to meat producers.

- How can we profit from movement in impactful inflation? We primarily care about making money so we can mitigate inflation movements whether up or down because there will be companies that benefit from the movement and companies that will suffer from the same movement. We want to position ourselves and if possible, hedge our investment strategy.

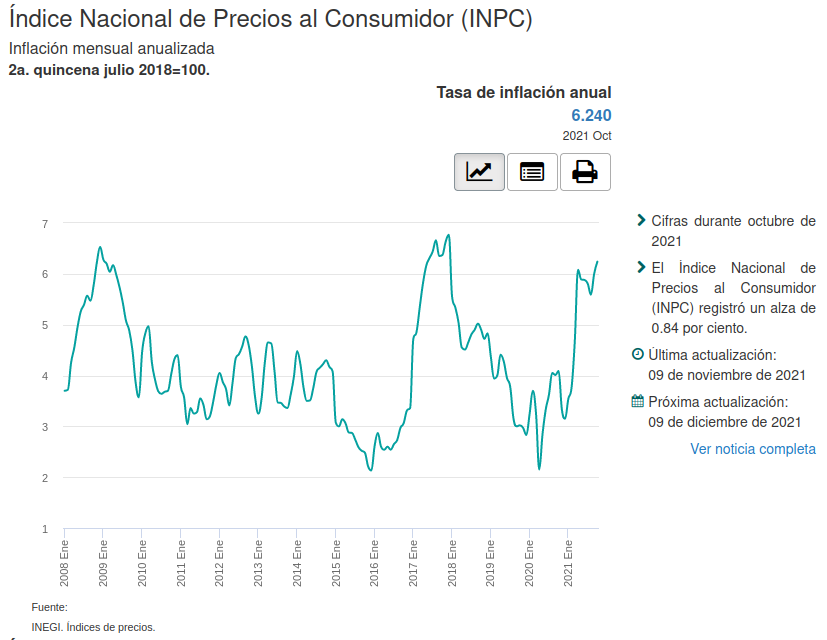

Yesterday, Mexico released their inflation rate data and showed inflation still high at 6.24% year over year.

Why should anyone here care about what the inflation rate in Mexico is right now? Mexico is one of the largest trading partners of the United States. Mexico comes in at Number 2 for imports and exports to the United States for goods. Inflation in Mexico will impact consumption of American products as well as American’s consumption of Mexican products.

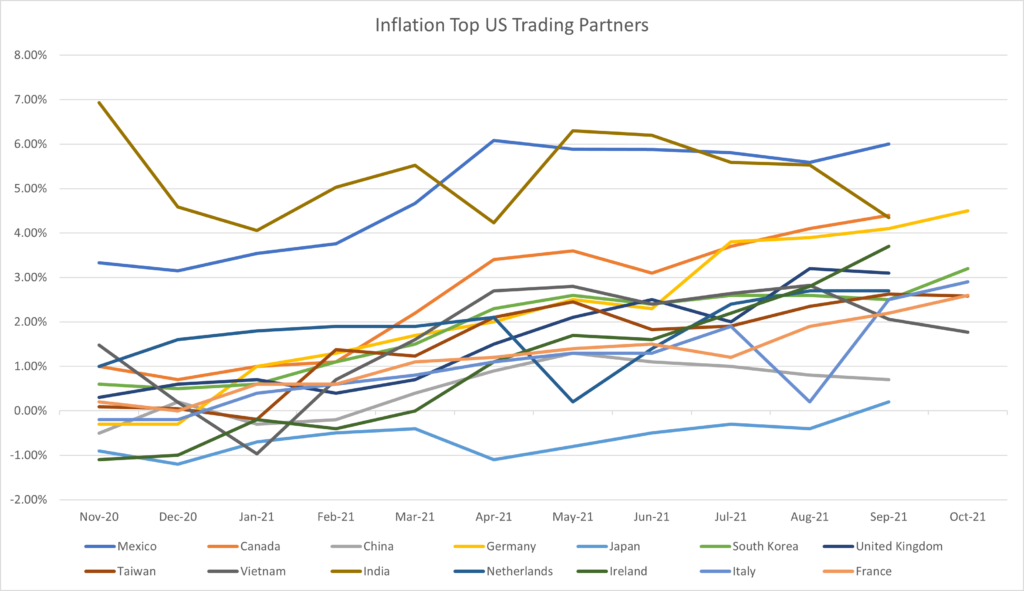

We have been observing a disturbing trend of inflation across all major trading partners of the United States over the past year.

How do we position our portfolio to hedge against inflation and/or generate some profits from this conundrum? During times of high inflation, defensive stocks are generally the way to go. Our favorite stocks in this area are Proctor and Gamble, Coca-Cola and a few others that pay consistent dividends and serve as “necessities” for most consumers. In a future post we will dive into Proctor & Gamble and discuss why we like the stock during inflationary and non-inflationary times. We think the stock may be a little high right now but may pick up some shares during any pullbacks/declines in PG stock price over the next few months.

[…] we took at inflation around the world and we didn’t like the numbers we saw and today the BLS released consumer inflation data and […]

[…] earlier posts, we took a look at global inflation and inflation in Mexico to understand what the inflation dynamic is with the United States largest […]

[…] inflationary problem isn’t contained to Mexico though, as we wrote about in Global vs National inflation, almost all of the top U.S. trading partners are experiencing higher than normal […]

[…] in this because Mexico and Canada are the U.S. largest trading partners and we care concerned about inflation impacting our portfolios and economic future. There is already a trucker shortage of approximately […]

[…] clogged shipping ports, massive inflation, shortages, demand for more real estate space, and more, the Stacker article is fairly […]

[…] course what goes around comes around as we reported in National Inflation vs. Global Inflation, top global exporters to the US have also been exporting inflation into the […]