Friday’s 6.8 percent inflation rate for the U.S. has us thinking about the rise in inflation globally and we have been doing some research. Specifically, we were interested in finding out if central bank interest rates matter as it relates to inflation. In theory, “cheap money” from low central bank rates and borrowing should be a key driver for inflation.

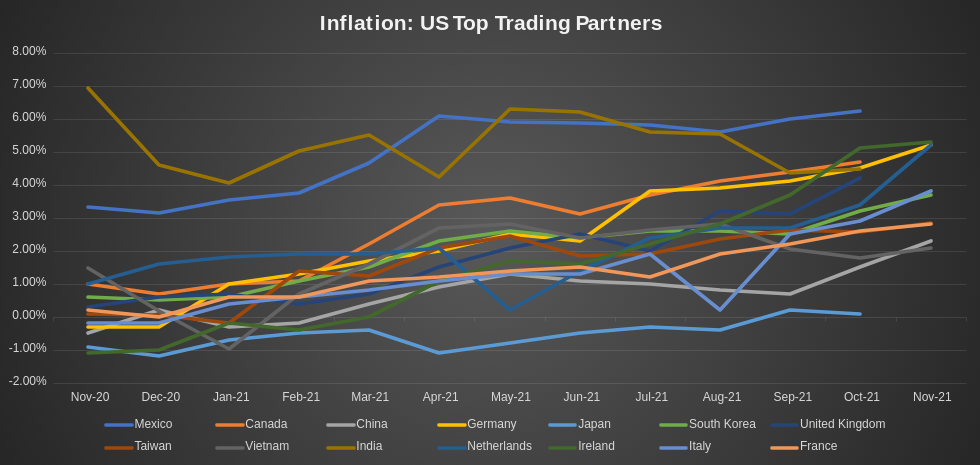

First, let’s take a look at the inflation rates from key global US trading partners as of December 10, 2021. The trend is clear, inflation is climbing for almost all of the trading partners.

We took the inflation rates and looked up the central bank rates for each trading partner.

Central Bank Rates and Inflation (December 2021)

| Country | Central Bank Rate (Dec 10 2021) | Inflation Rate (Dec 10 2021) |

| Mexico | 5.00% | 7.37% |

| Canada | 0.25% | 4.70% |

| China | 3.85% | 2.30% |

| Germany | 1.76% | 5.20% |

| Japan | -0.10% | 0.10% |

| South Korea | 0.75% | 3.70% |

| United Kingdom | 0.10% | 4.20% |

| Taiwan | 1.13% | 2.84% |

| Vietnam | 4.00% | 2.10% |

| India | 4.00% | 4.48% |

| Netherlands | 0.30% | 5.20% |

| Ireland | 0.00% | 5.30% |

| Italy | 0.00% | 3.80% |

| France | 0.00% | 2.80% |

We didn’t find too much correlation between central bank rates and inflation. Mexico has a high central bank rate and high inflation. Japan has low central bank rates and low inflation. Those may seem like correlation but most other countries have low central bank rates and high inflation.

There is a strong correlation however between high inflation and consumer pain. India is starting to see massive wholesale inflation not just inflation in consumer goods and that doesn’t bode well for returning to normal anytime soon. Around the world, inflation is causing people to go hungry from Singapore to the United States as people seek out food banks to eat.

The best thing to do is to ensure you have additional income coming in to help pay for basic necessities. We think the best way is to build a defensive portfolio (priority) coupled with a growth portfolio (secondary) but everyone’s situation is different to plan accordingly.

We think inflation will stick around for at least a couple of years, especially considering the changing boomer (retiring) demographics that will occur between 2021 and 2030. We also think this stock market is far overvalued for an inflationary period and an upcoming deflationary period around 2030.

While we wait for major market corrections, we will slowly acquire value stocks that pay dividends and have some potential for safe returns.

[…] high inflation globally and our desire to earn additional income to offset increasing prices in our defensive portfolio we […]