We’re half way through 2022 and while we have been waiting for the Federal Reserve to halt interest rate hikes to do heavy investments, we have been nibbling at the market and picking up value dividend stocks. Here is an update on our portfolio:

2022-07 Stock Portfolio

| Ticker | Company | Industry | Dividend | P/E |

| BHP | BHP | Industrial Metals & Mining | 13.22% | 8.75 |

| BMY | Bristol-Myers Squibb | Healthcare | 2.83% | 26.65 |

| BP | BP | Energy | 4.63% | N/A |

| BWA | BorgWarner | Auto Parts | 2.02% | 12.33 |

| CMCSA | Comcast | Comm Svcs | 2.71% | 12.84 |

| CSCO | Cisco | Comm Equip | 3.62% | 15.16 |

| GILD | Gilead Sciences | Healthcare | 4.65% | 17.52 |

| ILPT | Industrial Logistics Properties Trust | REIT Industrial | 9.28% | 10.06 |

| MPW | Medical Properties Trust | REIT Healthcare | 7.44% | 8.33 |

| PRU | Prudential | Insurance | 5.06% | 7.77 |

| RY | Royal Bank of Canada | Financial Banks | 4.10% | 11.06 |

| STT | State Street Corporation | Financial Asset Mgmt | 3.66% | 2.28 |

| SWK | Stanley Black & Decker | Industrials Tools | 2.95% | 14.31 |

| SWKS | Skyworks Solutions | Technology Semiconductors | 2.34% | 11.92 |

| MATV | Mativ | Basic Materials Paper Products | 7.85% | 9.71 |

| TWO | Two Harbors | REIT Mortgage | 14.23% | 11.71 |

| UGI | UGI Corp | Utilities | 3.72% | 7.02 |

| VFC | Vanity Fair | Consumer Cyclical Apparel | 4.47% | 14.78 |

| VZ | Verizon | Telecom Services | 4.97% | 9.87 |

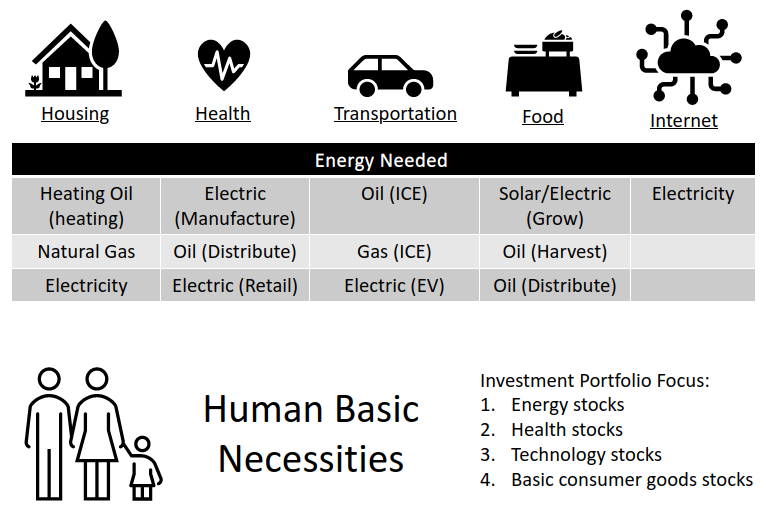

We consider our portfolio a defensive stock portfolio and we worked hard to find value dividend stocks that will pay dividends consistently and possibly grow. We wanted to cover all the human “essentials” in our list from housing, health, energy, and communications.

We also advise that you should conduct your own due diligence and not that this is not a recommendation for you to buy any equity. You should also read our Disclaimers page.

Also note that we have only purchased small positions in most of these equities and will hold on making any large purchases until we feel confident the Federal Reserve is done raising interest rates.

As always, stay tuned and stay solvent…

[…] is defensive and dividend value stocks to help increase income flows. We recently posted our portfolio so now is a time to take a look at how we’re sailing through these rough inflation […]

[…] We continue to invest in defensive and dividend value stocks and we’ve picked up shares of some new companies we’ll be writing about in an upcoming post. To take a look at our current portfolio, have a look at our July post. […]