In Predicting The Post Pandemic Stock Market Crash, we took a look at past stock market crashes trying to figure out where we are headed next. We also looked at the Federal Funds Rate (FFR), the rate which banks are able to borrow from the Federal Reserve and subsequently all borrowers, to understand the role the FFR has had on prior crashes and recoveries.

For the 2000-2002 stock crash, we took the FFR and amplified the values so they would fit on the chart by multiplying the FFR x 20 otherwise it would be a tiny line at the bottom. As you can see from the graph below, the FFR began to lower rates as soon as the market fell precipitously. The FFR rate was at 5.85% and dropped to 1.75% at which point the QQQ bottomed and began recovery.

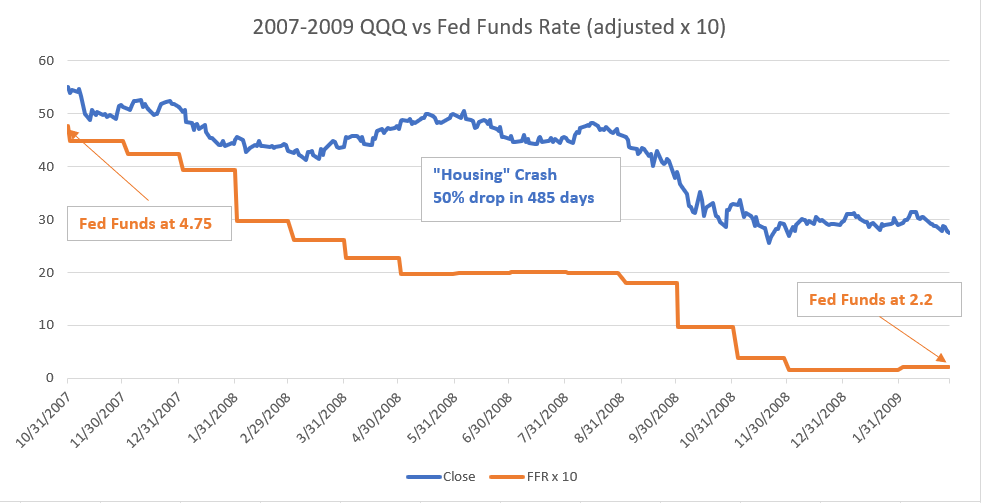

For the 2007-2009 housing crash, we amplified the FFR by 10 given the scale for QQQ was much lower than the in 2000. The Fed dropped FFR from 4.75% down to 2.2% at which point QQQ hit bottom and began to recover.

Where are we in 2022? If we start at the peak on 11/19/2021 for QQQ and a FFR of 0% we can’t help but not that we aren’t dropping but climbing! We are in unique circumstances where the Fed is force to raise rates due to rampant inflation but the stock market has started a journey of descent.

What does this all mean? We can’t imagine a situation where the stock market has started a correction, the cost of borrowing is INCREASING, the cost of goods and services INCREASING due to inflation, that would lead to greater profits for companies.

Some people in the investment community have been warning that the next crash will be colossal and it is entirely possible that is the scenario that unfolds but we’ll keep running our models to see some possible alternatives.

In the meantime stay tuned and stay solvent…

[…] we have seen a correction of 27% but it’s only been 252 days from the peak. As we wrote in QQQ and the Fed Funds Rate, we are in uncharted territory. In prior market crashes, the Federal Reserve had to lower rates in […]