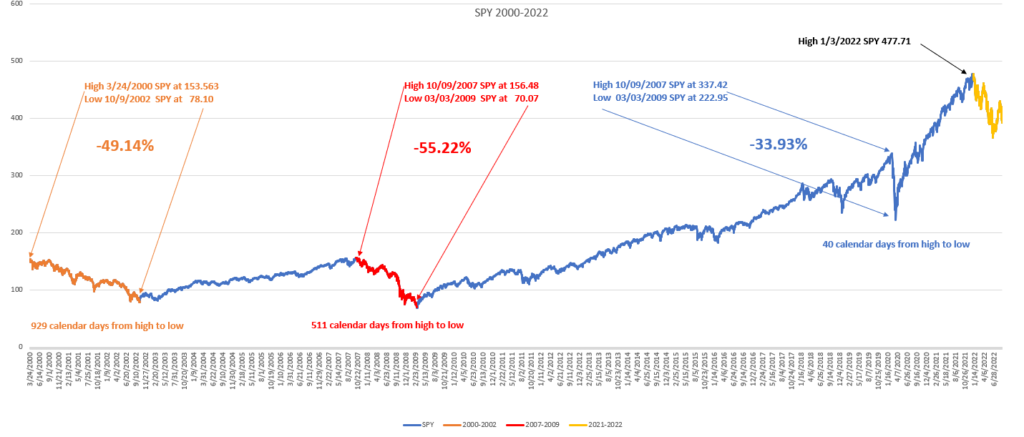

We’ve been looking at previous stock market crashes from 2000 thru 2021 for SPY and QQQ as our benchmark. We charted the crashes on a chart and did some calculations. Let’s take a look at SPY

The SPY has had three major crashes since 2000. The first happened in 2000 and lasted thru 2002 (929 calendar days) and resulted in a decline of 49.14% of SPY. The second crash happened in 2007 thru 2009 (511 calendar days) and featured a 55.22% correction. The third crash was a pandemic induced panic that resulted in a 33.93% drop over 40 calendar days. We believe we are now in the fourth crash which had SPY peaking on 1/3/2022 at 477.71.

The QQQ has also had three major crashes since 2000.

The first QQQ crash happened started on 3/27/2000 and finished on 10/9/2002 for a total of 926 calendar days for an 82.96 percent descent to complete. The second crash began on 10/31/2007 and bottomed on 3/9/2009 which was a journey of 495 days and a loss of 53.23%. The third crash, caused by the pandemic panic, took 35 days and resulted in a 23% drop.

We expect the QQQ to likely correct all the way down to the 200 mark if prior crashes hold and expect that journey to last through the end of December 2023 or early 2024. As of 9/5/2022 we have seen a correction of 27% but it’s only been 252 days from the peak. As we wrote in QQQ and the Fed Funds Rate, we are in uncharted territory. In prior market crashes, the Federal Reserve had to lower rates in order for the market to recover however the market is starting to “crash” and the Fed is raising rates in order to combat overheated inflation with no slow down in sight.

We think the speed (in calendar days) and depth (in terms of losses) is largely dependent on what the Federal Reserve does with the Fed Funds Rate over the next 12 months. If the Fed continues to hike aggressively, we think the crash will be faster and deeper. If the Fed slows the growth of the Fed Funds Rates or pauses hikes, we expect a longer slower burn that may take a correction out to late 2026 or early 2027.

In either event, we think the market is heading toward a sandbar and there is little anyone can probably do about it except protect portfolios with put options or selling equities that will be hit the hardest.

We are researching companies we think will struggle and will buy put options with our bottom target to protect our portfolio and reap some additional profits. In the meantime stay tuned and stay solvent…