We’ve been tracking XHB for some time now. Back in August, we wrote How To Profit from a Housing Correction/Crash and followed that up with Time To Profit From A Housing Crash and today we’re taking one more look at XHB through the Fed Funds Rate lens.

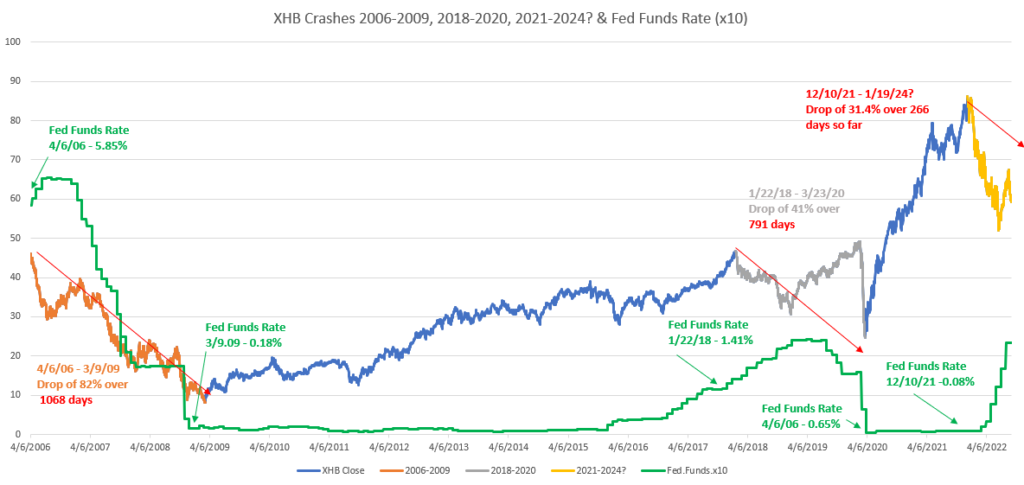

There have been two XHB crashes over the past 16 years. The first began on April 6, 2006 when XHB peaked at 46.02 then dropped over 1068 days to 8.23 on March 9, 2009. From 2004 thru 2006, the Fed raised interest rates from 1% to 5.25% and subsequently began the long descent of XHB.

The second crash started on January 22, 2018 when XHB fell from 46.75 down to 24.72 over 791 days. During this time frame, the Federal Reserve was once again engaged in hiking interest rates from 1.41% to 2.4% over that period.

We believe we our now entering a third crash which could take XHB down 50% to 80% dependent on how fast and how high the Federal Reserve raises interest rates. If we take the XHB peak of 86.27 that happened on December 10, 2021 and count the days since that peak, we are at 266 days and a 31.4% drop as of the date and time of this post. Given the steep angle and drop off, we can guesstimate that another 266 days may cause an additional 31.4% drop to put us at 532 days at a 62.8% drop which could put XHB at 29 on May 31, 2023.

The same concept applies to many of the home builders inside the XHB ETF and as we have point out, some home builder stocks in the ETF have higher levels of debt than others. Those with higher levels of debt will find it difficult to handle that debt at higher interest rates and the Federal Reserve has not signaled that it intends on stopping rate hikes so far.

The best way for us to potentially profit from this scenario is to buy PUT Option contracts on XHB and various other home builder stock we think may struggle in the future. Please note that options trading has a high degree of risk and not appropriate for every investor so please seek the advice of a financial advisor before making any investment decisions.

In the meantime stay tuned and stay solvent…

[…] is plenty of opportunity to make money in markets going up and down. As we’ve noted, we have positioned ourselves with PUTS in a variety of ETFs/equities and will continue to research […]

[…] already have put options on XHB and wanted to take a closer look at three key home builders: Toll Brothers; DR Horton and Lennar. […]

[…] the meantime, our XHB put positions were briefly in the money as XHB dropped down to 55.45 today but we expect XHB to go down to the 30 […]