The BLS released their December Consumer Price Index and the data shows some progress but problems still persist. Let’s take a look:

The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.1 percent in December on a seasonally adjusted basis, after increasing 0.1 percent in November, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 6.5 percent before seasonal adjustment. The index for gasoline was by far the largest contributor to the monthly all items decrease, more than offsetting increases in shelter indexes. The food index increased 0.3 percent over the month with the food at home index rising 0.2 percent. The energy index decreased 4.5 percent over the month as the gasoline index declined; other major energy component indexes increased over the month. The index for all items less food and energy rose 0.3 percent in December, after rising 0.2 percent in November. Indexes which increased in December include the shelter, household furnishings and operations, motor vehicle insurance, recreation, and apparel indexes. The indexes for used cars and trucks, and airline fares were among those that decreased over the month. The all items index increased 6.5 percent for the 12 months ending December; this was the smallest 12-month increase since the period ending October 2021. The all items less food and energy index rose 5.7 percent over the last 12 months. The energy index increased 7.3 percent for the 12 months ending December, and the food index increased 10.4 percent over the last year; all of these increases were smaller than for the 12-month period ending November.

We highlighted the key points. Inflation increased in some areas and decreased in others but the areas that matter to most people INCREASED (food, shelter, household furnishing and operations, recreation and apparel).

A key decline in inflation was lower energy prices but we think that will be a short reprieve as China fully opens up and increases energy use. The Ukraine-Russia conflict won’t help reduce the cost of energy either.

Where do we go from here? The Fed will continue to hike interest rates raising the cost of borrowing and debt as well as mortgage interest rates. The US dollar may continue to climb as well which won’t bode well for exports.

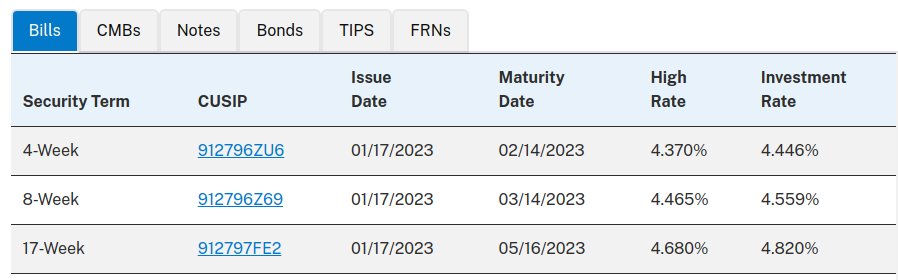

Our current investment strategy largely centers around laddering 17-week US Treasury T-bills which i currently paying 4.57 percent and we expect will climb as the Fed raises rates.

Stay tuned, stay profitable and stay solvent…