The market is giddy with excitement and greed this week despite the Federal Reserve raising interest rates again so let’s take a look at the charts. Starting with SPY crash comparisons

Markets don’t crash or correct in a straight line and this time will be no different. SPY is following the dot com crash pattern but anything can happen.

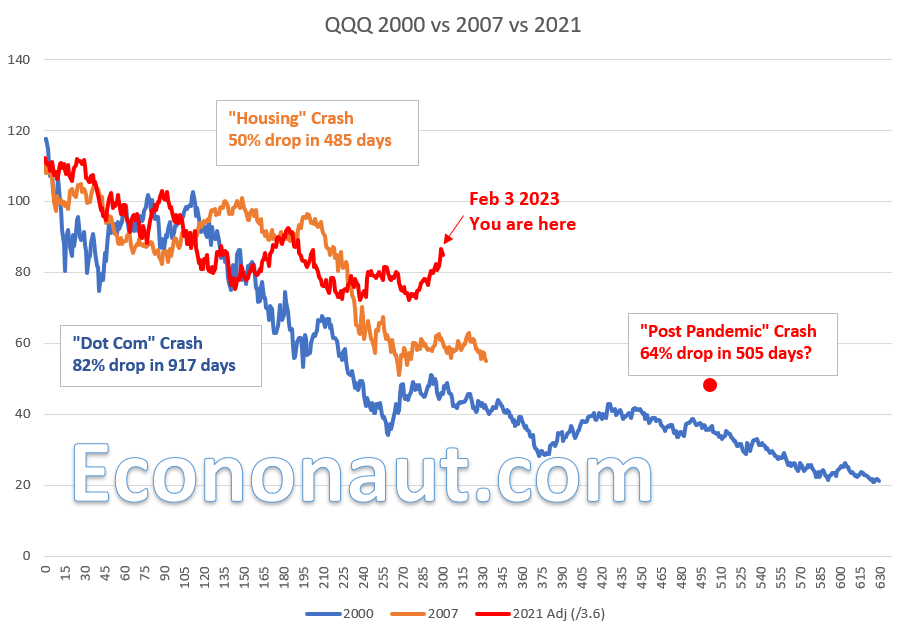

Surprisingly, the QQQ’s are behaving in a hybrid manner merging the housing crash pattern with the dot com crash pattern.

Finally, the XHB crash pattern is mimicking the original housing crash pattern with offset rallies and slumps and we expect the downward trend to start soon but take all the way to the end of 2023 to really start bottoming. We have taken the opportunity during these XHB rallies to buy more PUTS on XHB for January 19 2024 expiry at the $55 strike prices so we could dollar cost average down or previous PUT purchases.

The next Federal Reserve meeting will be on March 21-22 and the Fed will likely hike again given the surge in JOLTS to 11 million and other positive labor news but we’ll wait and see so stay tuned, stay profitable and stay solvent…