In Our 2024 Investment Strategy for Equities, we introduced our DIVOS™ strategy and during this week’s market turmoil, we initiated a very small position in STT (State Street) and intend to hold and accumulate this stock for the foreseeable future.

Here’s how we think it fits our DIVOS model.

Demographics

State Street Corporation provides a range of financial products and services to institutional investors worldwide. We like State Street because if you like ETFs then it’s likely State Street is somehow involved with it. As for demographics, every person should have some type of investment portfolio but only a small portion of people do so State Street has huge potential for growth over time.

Income

STT is a dividend contender which means it has been paying dividends for at least 10 years but less than 24 and our goal is for at least another 10 years of dividends from this equity. STT has generated a a respectable $64k net income per employee in 2023 and has a 5 year average net income per employee of $63k.

Value

As of the time of this post, STT is trading at about 9 percent over it’s 52 week low. We will slowly accumulate shares from here but we are keeping an eye on the market volatility and for bond rates to stabilize before we make any significant purchases in this stock.

Options

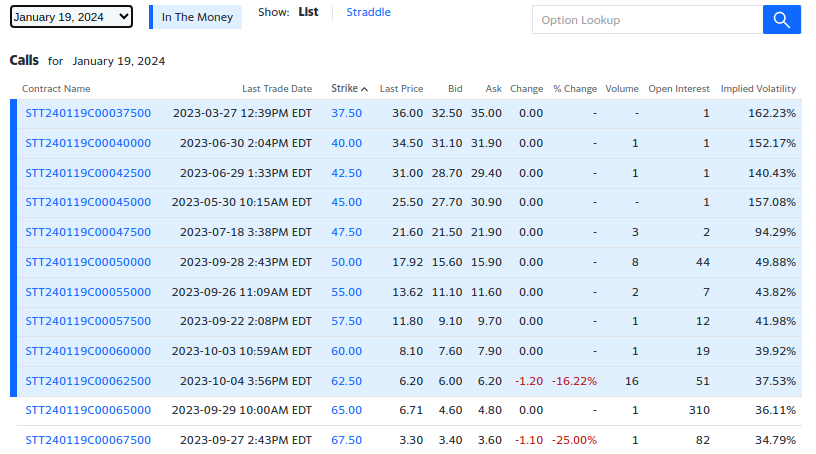

STT has an options market and we look forward to selling cash secured PUTS and sell covered calls on this stock to squeeze more value and profits out of this equity. As of 4th of Oct 2023 the call option table below shows a potential yield of about 10% for a buy-write trade executed for January 2024 out-of-money trade today theoretically.

S&P 500

STT is a member of the S&P 500 and while it is categorized as a Financial industry we think it fits our bias toward three industries moving forward: Healthcare, Technology & Consumer Discretionary. We think STT fits between technology and consumer discretionary in addition to Financial. If you want to know why we favor these three industries, check out the S&P 500 Sector Performance chart.

We’ll let you know as we accumulate more, we’ve already set our STT to DRIP (Dividend Re-investment Plan) so we’ll be acquiring shares automatically once we receive dividends but we’ll also buy more via cash secured puts and buy-write trades so stay tuned, stay profitable and stay solvent…