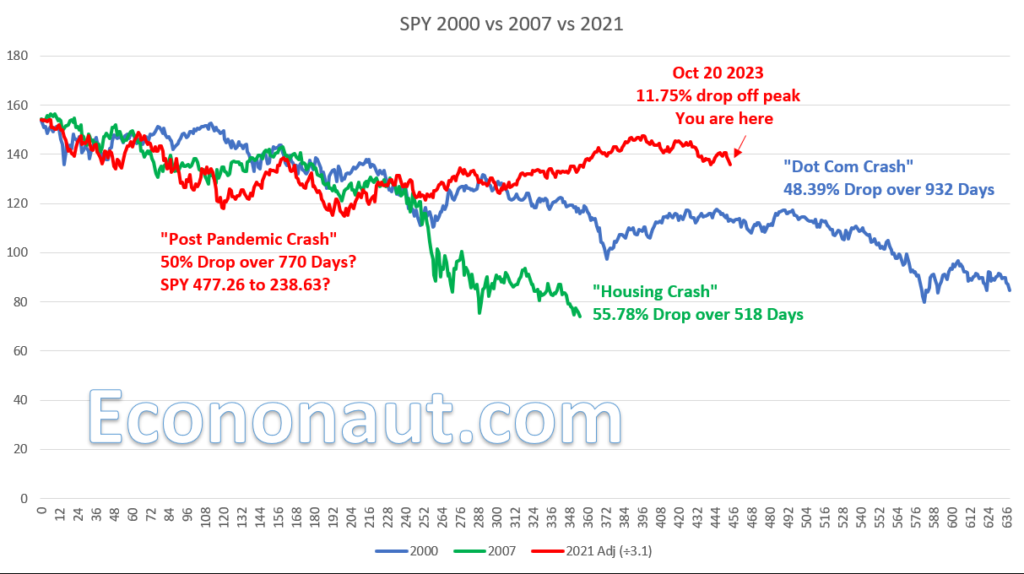

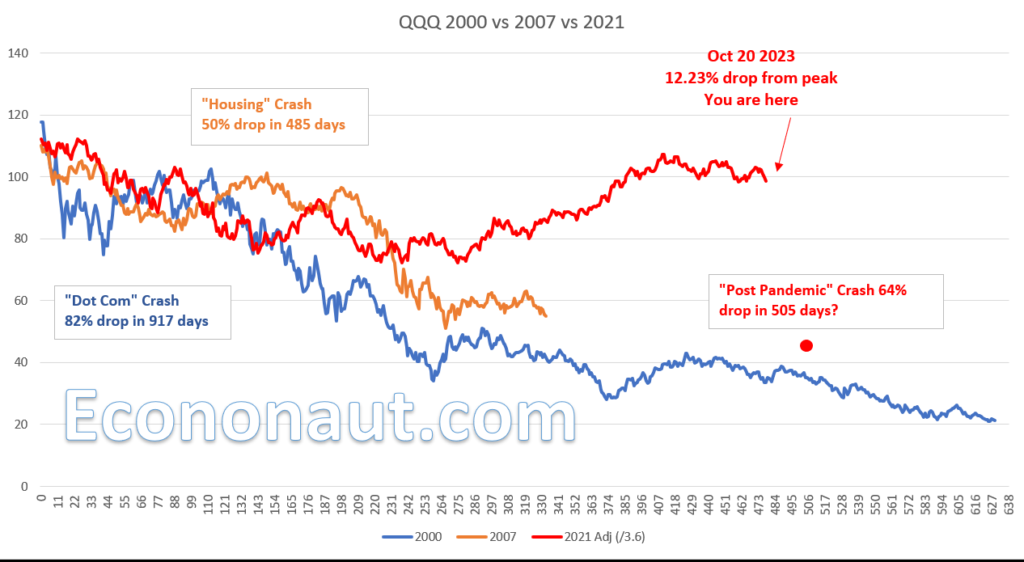

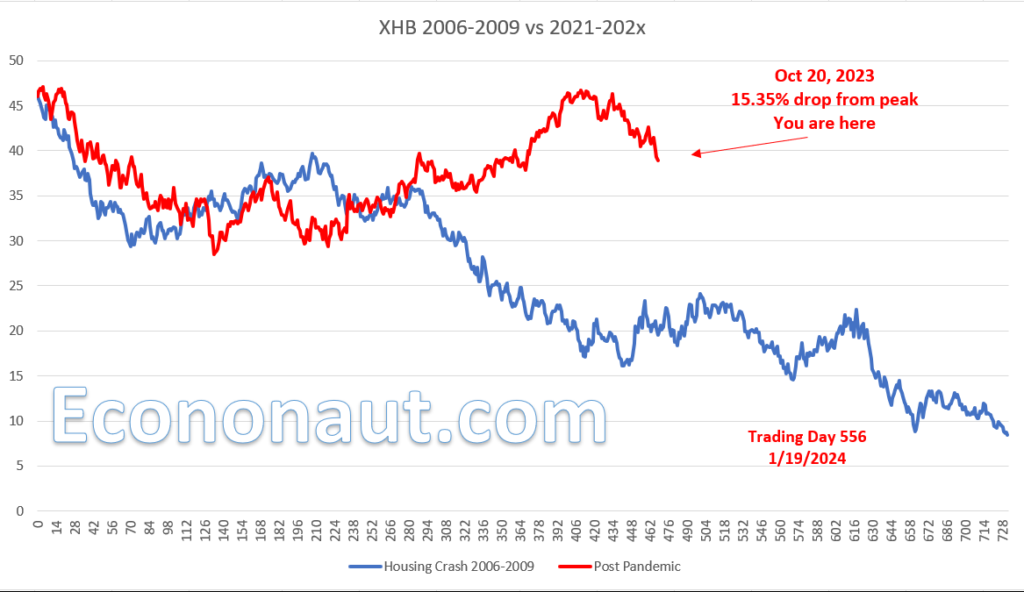

The 10 Year Treasury breached 5 percent this week. There is an escalating war in the middle east and mortgage rates hit 8 percent so what better time than to check in with our SPY, QQQ and XHB crash comparisons. First up SPY:

SPY is starting to crack again with a downtrend for most of October. The macro events are starting to take a toll on everyone’s psyche and the stock market. The SPY is down about 11.75% from it’s all time peak post COVID. Next up the QQQs:

The QQQs are 12 and a quarter percent from all time post-COVID peak and the darling tech sector is starting to lose some luster. Finally XHB:

We hold put positions on XHB for January 2024 expiry and we are waiting to see what will happen. XHB has lost the most since covid with a drop of 15.35 percent and with the residential and commercial real estate markets nearly frozen it’s no wonder. We tried to buy more puts on XHB and home builders but our limit prices weren’t accepted.

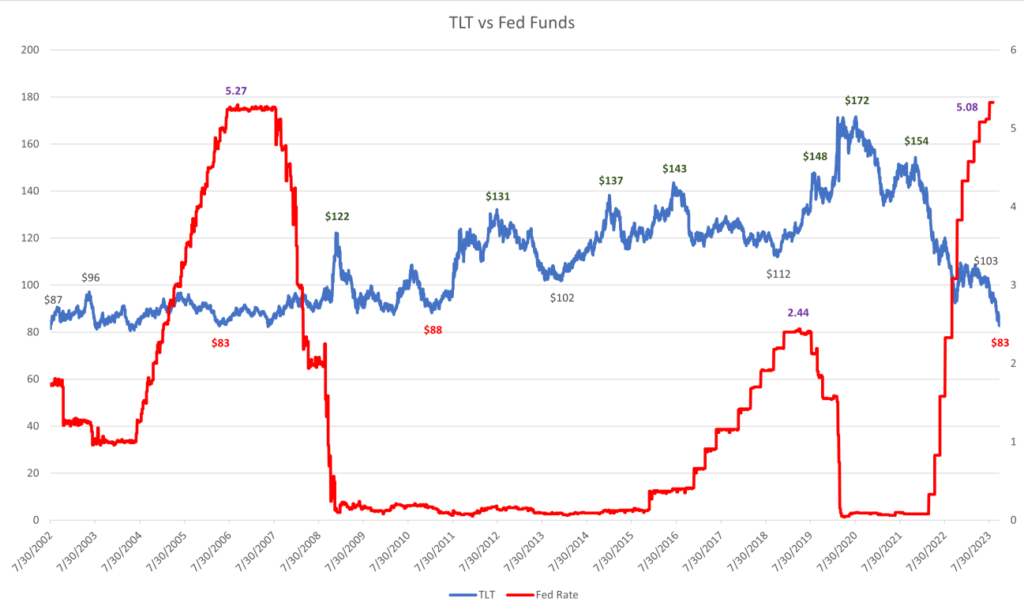

What we have been making is small purchase on is TLT. The TLT is an ETF that tracks the 20 year bond US Treasury and it reached all time lows this week and is poised to fall further so we will keep nibbling at shares via naked puts and covered calls on rallies.

For now we’ll just keep watching the market so stay tuned, stay profitable and stay solvent…