In Our 2024 Investment Strategy for Equities, we introduced our DIVOS™ strategy and during this today’s market turmoil, we initiated a very small position in PFE (Pfizer) and intend to hold and accumulate this stock for the foreseeable future.

Here’s how we think it fits our DIVOS model.

Demographics

Pfizer is a pharmaceutical company that produces drugs all over the world. It’s been down on its luck lately with some failed trails but we think it’s at a great discount.

Income

Pfizer currently has a dividend of 5.84 percent, although, if Pfizer’s prospects don’t improve they may cut the dividend at some point in the future but that’s ok with us because we also know that there will be hundreds of millions hooked on some type of drug, especially the older boomer generation.

Value

As of the time of this post, Pfizer is about 50% of it’s value from the December ’21 peak of $59.05 and we bought in around $29 and intend on holding and accumulating long term. We will DRIP our shares as we earn dividends.

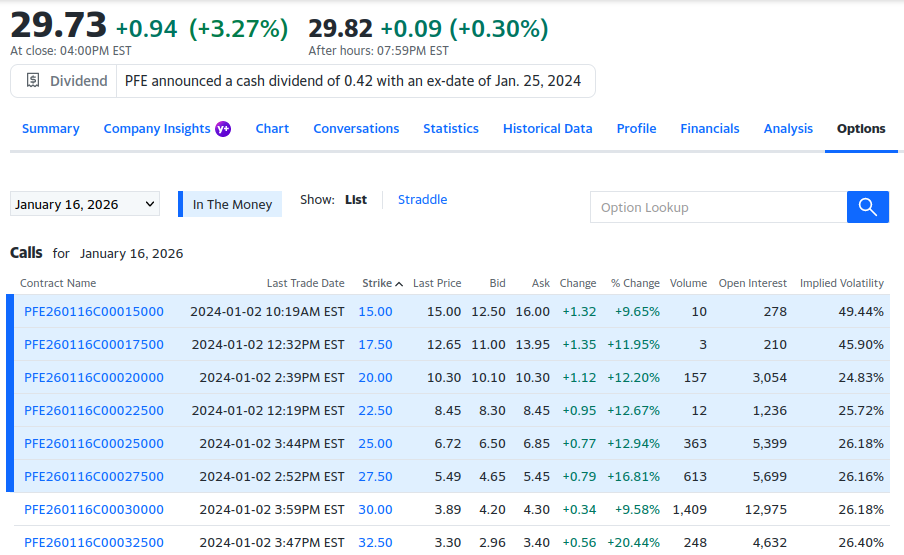

Options

PFE has an options market and we look forward to selling cash secured PUTS and sell covered calls on this stock to squeeze more value and profits out of this equity. As of January 2nd 2024 the call option table below going far out into 2026 shows a possible 13% return sans dividends for the call option.

S&P 500

PFE is a member of the S&P 500 and is categorized as Health care and serves as a diversification point in our portfolio.

We’ll let you know as we accumulate more and it may be a while since the stock is very volatile right now but we’ve been expecting this correction for a long while now. Remember to be greedy when others are fearful and be fearful when others are greedy. To keep up to date, stay tuned, stay profitable and stay solvent…