In Our 2024 Investment Strategy for Equities, we introduced our DIVOS™ strategy and today, we initiated a very small position in O (Realty Income) and intend to hold and accumulate this stock for the foreseeable future.

Here’s how we think it fits our DIVOS model.

Demographics

Realty Income is known as The Monthly Dividend Company. It is a REIT that holds a diversified portfolio or real estate covering 85 separate industries and boasts a current 98.8% occupancy. Virtually every person eventually enters some type of retail real estate property at some point in their day.

Income

O currently has a dividend of 5.88 percent as the stock has been beaten down from a 52 week high of $67 to it’s current $52 range. We’ve put this stock in our taxable account and hope to achieve qualified dividend status over the next 6 months and accumulate more over time.

Value

The commercial real estate market is in a bit of a haze right now and there is always the possibility that there may be further correction or even total deterioration but we think O will see light at the end of the tunnel. We will DRIP our shares as we earn dividends and hopefully take advantage of any dips from here.

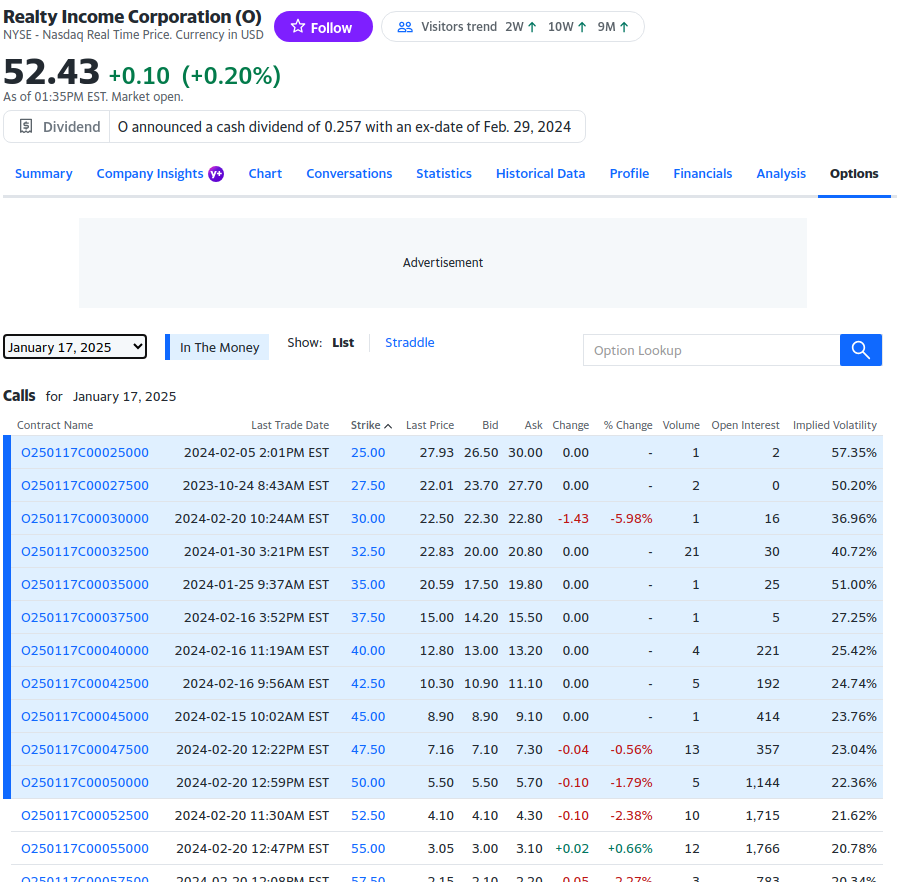

Options

O has an options market and we look forward to selling cash secured PUTS and sell covered calls on this stock to squeeze more value and profits out of this equity. As of February 20 2024 the call option table below going far out into January 2025 shows a possible 7.5% return sans dividends for the covered call option OTM $52.50 strikes.

S&P 500

O is a member of the S&P 500 and is categorized as Real Estate and serves as a diversification point in our portfolio.

We’ll let you know as we accumulate more and it may be a while since the stock market keeps shooting for the moon and it’s harder and harder to find value. Stay tuned, stay profitable and stay solvent…