In Our 2024 Investment Strategy for Equities, we introduced our DIVOS™ strategy and today, we initiated a very small position in JNJ (Johnson & Johnson) and intend to hold and accumulate this stock for the foreseeable future.

Here’s how we think it fits our DIVOS model.

Demographics

Johnson & Johnson is a full spectrum healthcare company offering through research, development, manufacturing, and product portfolio a wide variety of healthcare products and services. Virtually every person eventually uses a JNJ product on any given day.

Income

JNJ has a forward yield of 3.43% as of the time of this post and the stock has recently declined to around $145 today. The company boasts an impressive $291.7k net income per employee and is a member of the Dividend Kings as of 2024.

Value

The healthcare industry is currently in defensive mode right now which has brought JNJ stock down to a fair value level. Note that we initiated a small position and plan to accumulate more over time if it corrects further down. We will DRIP our shares as we earn dividends and hopefully take advantage of any dips from here.

Options

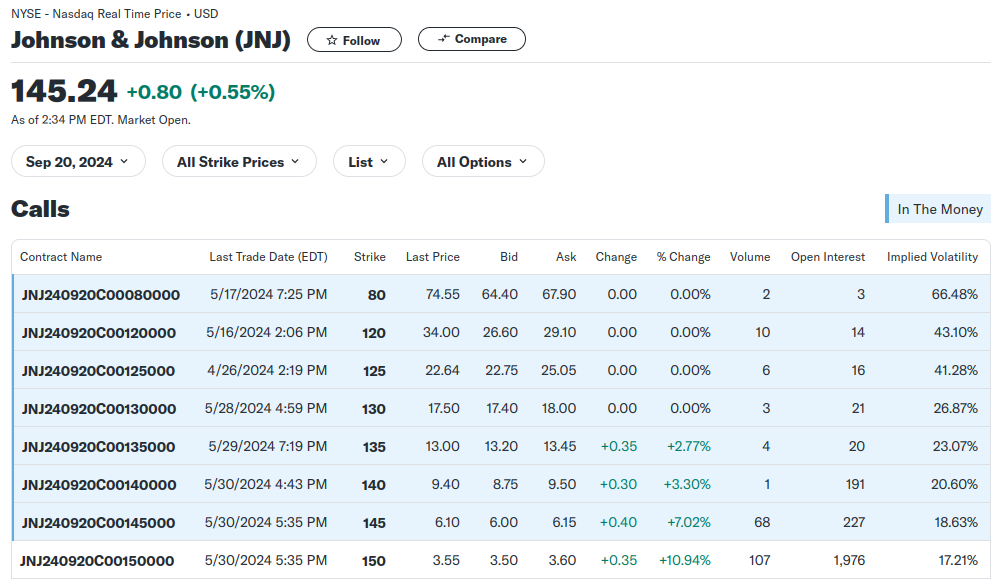

JNJ has an options market and selling an ITM $145 strike for September 2024 would yield about 6.4 percent so there is potential to squeeze additional income via covered calls in the future.

S&P 500

JNJ is a member of the S&P 500 and is categorized as drug manufacturers and serves as a diversification point in our portfolio.

We’ll let you know as we accumulate more and it may be a while since the stock market keeps shooting for the moon and it’s harder and harder to find value. Stay tuned, stay profitable and stay solvent…