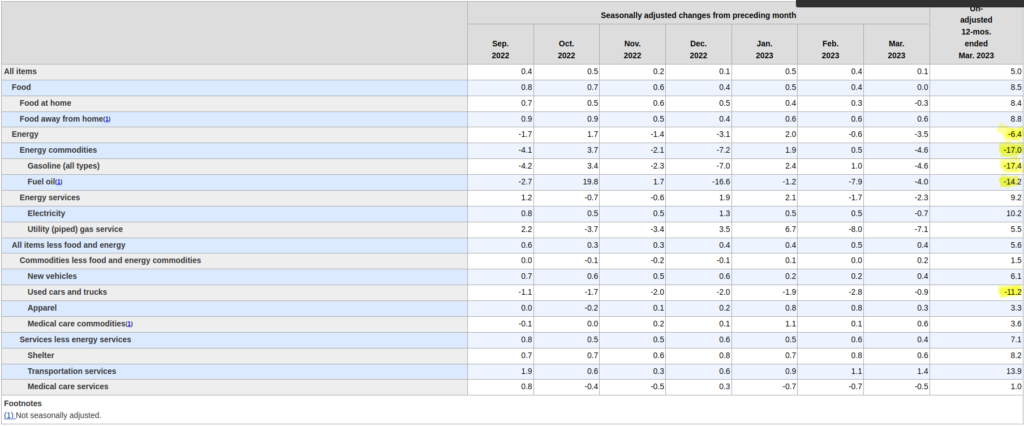

The BLS released the CPI report today and it shows inflation at 5 percent year over year. This is an improvement over the higher rate of 6 percent last month but it’s still high. Unfortunately, most of the reduction in inflation seems to have come from energy. Let’s take a look at the chart:

Energy dropped 6.4 percent for the month of March however the price of oil averaged over the month of March was $73.37 with a peak of $80.46 and a low of $66.74 but oil close at $83.26 at the time of this post.

The other culprit in the reduction of inflation was used cars and trucks which doesn’t really help the average consumer much.

Food was a whopping 8 percent only to be out done by electricity at 10 percent, ouch!

The important question is how do we profit from this information?

We took positions in DVN, PSX and currently hold positions in BP and have been selling calls when oil rallies and buy them back on declines to score 40% returns on our trades.

It is highly likely the Fed will continue to raise rates in May so stay tuned, stay profitable and stay solvent…