We’ve been looking at economic data and it’s bad. It’s part of the reason we had not made any recent posts. We did not want to share dire economic news exacerbated by labor shortages, debt and other issues but we have been analyzing data.

We had abandoned our stock market crash comparisons at the end of June 2023 because the market kept powering on higher and higher, boggling even the most tenured economic minds.

And while the market may go “hog wild” again and stampede all over our economic forecasts, we decided that unless a major black swan event happens, it will likely be a slow grind down for the market from here.

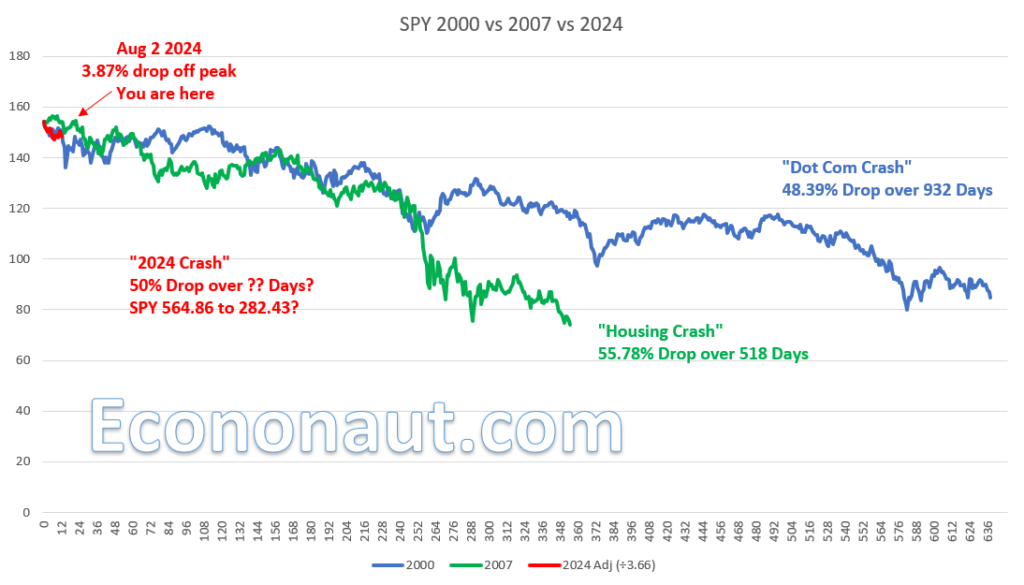

SPY 2000 vs 2007 vs 2024

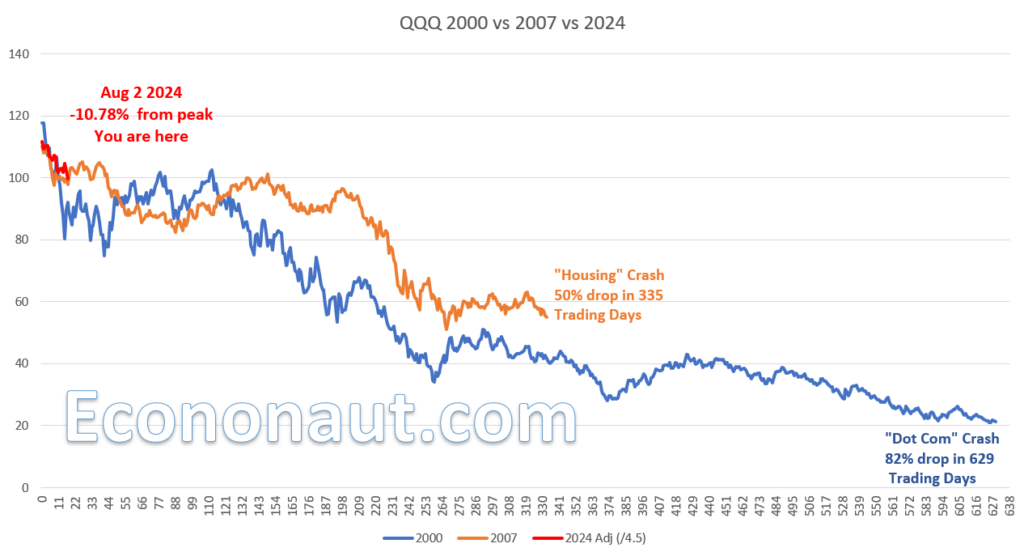

QQQ 2000 vs 2007 vs 2024

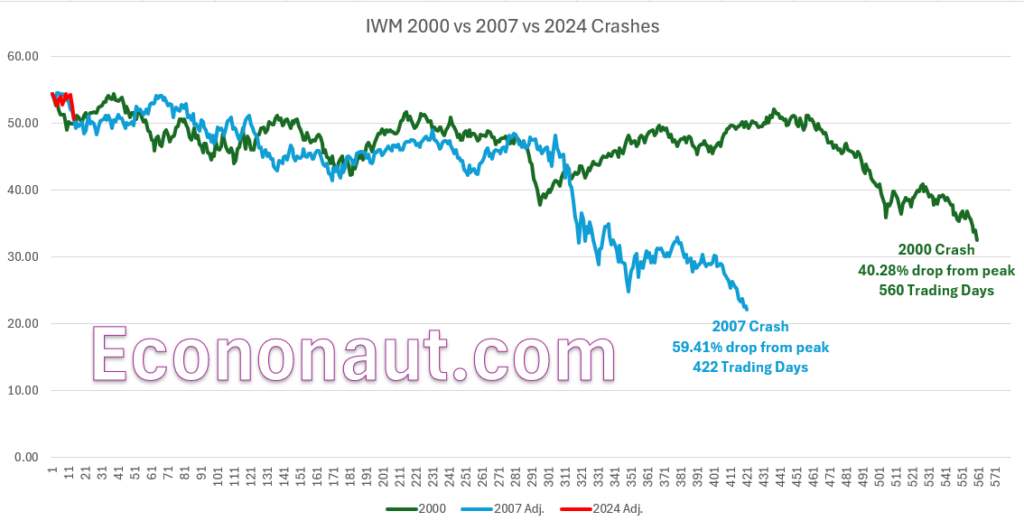

IWM 2000 vs 2007 vs 2024

Note that we abandoned tracking XHB because housing is in an even stranger place than the equities market and we have no way to determine where this will go aside from slowly grinding lower but given the housing anomalies across the country, red hot in one area and exploding inventory in others, we just don’t know.

Right now, we have been sitting on a large cash position with a few key value stocks in our portfolio. We expect to hold cash earning 5 percent t-bills until we find opportunities for better investments. We’ll keep you posted so stay tuned, stay profitable and stay solvent…